When a transaction has been selected (double clicked) from the transaction list, an Audit button is available to perform a low level enquiry on the transaction.

Screen Shot 78: Transaction Audit

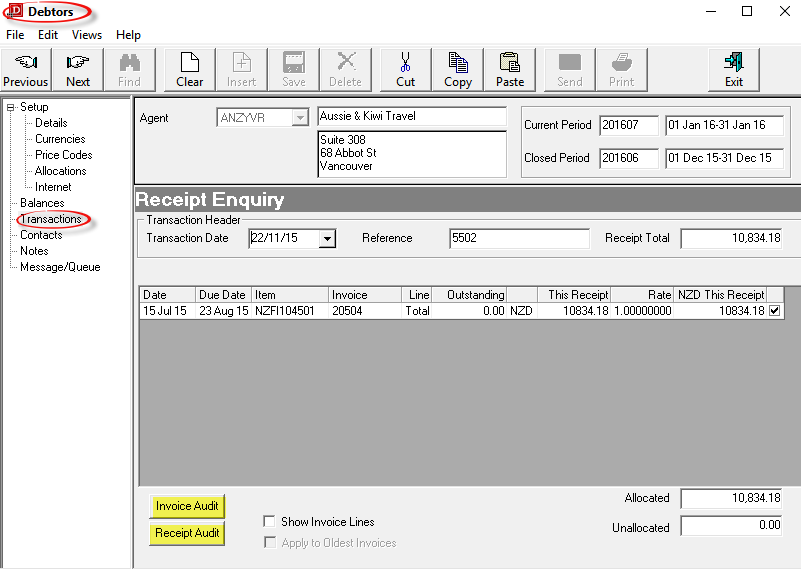

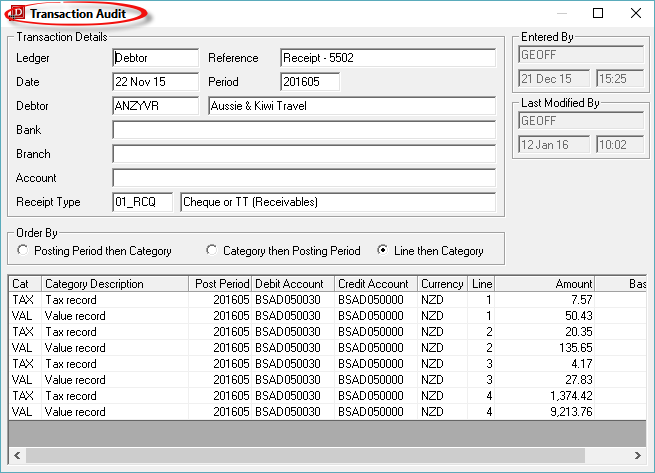

Receipt 5502 has been selected (double clicked) from the transaction list.

|

Because this receipt is in a Closed accounting period, the Transaction Bar heading shows Receipt Enquiry (or Invoice Enquiry/Credit Enquiry depending on the transaction type being viewed). This means that the receipt can not be altered. If the transaction being viewed is in an Open accounting period, the Transaction Bar heading will show Alter Receipt (or Invoice/Credit) |

|

When a receipt is selected, two audit buttons are available — one for the receipt, and one for the invoice that the receipt applies to. When an invoice is selected from the transaction list, only the Invoice Audit button is available. |

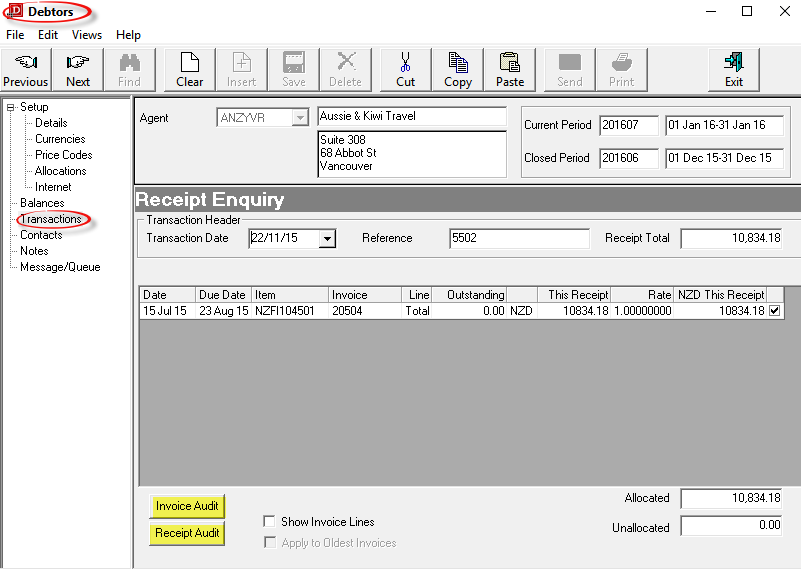

Screen Shot 79: Invoice Transaction Audit Display

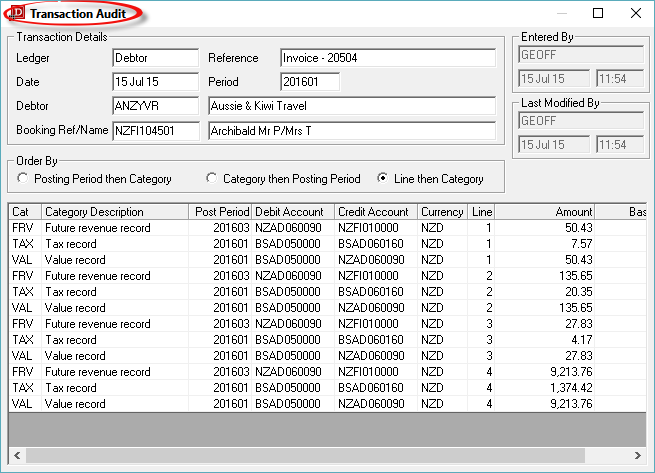

Screen Shot 80: Receipt Transaction Audit Display

|

The column headings at the top of these scrolls are the only column headings available in these screens. |

The only fields which can be accessed in the Audit displays are the 'Order By' which enable the records to sorted on screen in different orders. All others are display only.

|

Heading |

Displays |

|

Ledger |

When viewing via Debtors, this will always show Debtor. |

|

Reference |

Transaction type and reference number. |

|

Date |

Transaction date. |

|

Period |

Transaction Period (TRP). |

|

Entered By/Last Modified By |

The user name and time of transaction creation and last modification. |

|

Debtor |

The Debtor/Agent code and name. |

|

Booking Ref/Name (Invoice/Credit Audit Only) |

The booking reference and name that the Invoice/Credit Note applies to. |

|

Bank/Branch/Account (Receipt Audit Only) |

These are the Receipt Type user text (see Screen Shot 51 Receipt Type User Text Labels |

|

Receipt Type (Receipt Audit Only) |

The receipt type used on the receipt. |

|

Order By |

Use these radio buttons to change the order of the display. |

|

Cat |

The Line Category. |

|

Category Description |

The extended category description. For receipts, tax is never posted to a tax account — that posting is part of the invoice transaction. However, because there is a tax line in the invoice, there has to be a corresponding line in the receipt. Note that the posting accounts for both the TAX and the VAL lines in Screen Shot 80 Receipt Transaction Audit Display are the same, meaning that the total of the VAL and TAX records will be posted to those accounts. |

|

Post Period |

The G.L. posting period (GLP). |

|

Debit Account |

The. G.L. Account to be debited with the line amount. |

|

Credit Account |

The G.L. Account to be credited with the line amount. |

|

Currency |

The Currency of the transaction |

|

Line |

The transaction Line Number |

|

Amount |

The line amount in transaction currency. |

|

Base Amount |

The amount in system base currency. |